Get notified of the latest news, insights, and upcoming industry events.

Real time chat via computers has been around longer than you might think.

Steve Moreton, Senior Technical Director, CJC

Instant Messaging (IM) as a phrase was coined in the 1990s, but the concept of human beings being able to chat real time, via a computer terminal over a network, goes back to the mid-1960s. The ability is in fact so common and accepted, many of us forget how much instant messaging is part of our daily lives. The same must be said in the capital markets. IM has delivered huge improvements to the industry and been a pivotal aspect of market data vendor capabilities for almost forty years. IM has a bright future and is changing the shape of communication and workflow in the capital markets and beyond.

Let’s look at the timeline of its evolution:

1977

Forty years ago, Reuters began development on an electronic conversational dealing platform. The first users were working in 1979 and an ‘instant message’ took 4 seconds – a lifetime in today’s high frequency world.

The conversational dealing aspect was added to the Reuters dealing platform and had mass adoption in Dealing 2000-phase 1, which is very much the great-great grandparent of the Thomson Reuters FX Trading system – still in use by 14,000 users today.

1982 - 1990

Bloomberg had an internal messaging system, even in the earliest version of the terminal. As adoption increased and the community grew, that feature became more and more important. Between 1986 and 1990 the chat feature was added. Chat/IM could be argued to be the ‘killer app’ of the Bloomberg product which added significant growth to Bloomberg user base, now at 325,000 globally.

2002

Reuters introduces ‘Reuters Messaging’. Based on Microsoft Instant Messenger, this was a standalone application for capital markets users to communicate. A key differentiator from Bloomberg was the no charge for the standalone version, meaning many users who did not have terminal from the major vendors still had the ability to find and chat to the community. The success of the product ensured this was included in Eikon, the Thomson Reuters flagship desktop product. Eikon Messenger has more than 300,000 users.

2004 - 2007

The vendor applications were complimented by a variety of Instant Messaging platforms from mass market suppliers – Microsoft Live Messenger/Lync/Skype for Business, AIM and smart phone based versions, such as Blackberry Messenger drove IM throughout the middle and back offices. Many firms develop instant messaging internally – one example would be Live Current at Goldman Sachs.

2007

Instant messaging is so widely used that it is directly highlighted in the 2007 MIFID II guidelines. As a major communication platform in the capital markets, IM needs to be recorded with appropriate usage policies and technological safeguards. Both Bloomberg and Thomson Reuters offer capabilities for compliance teams to log and review IM.

2012 – 2013

Live Current eventually became Symphony. Symphony is focused on the capital markets and has funding from notable and high-profile institutions. It also provides USPs embracing high encryption community access, work flow and collaboration and an open API for developers.

In the mass market, Slack is available in public cloud, with similar capabilities to symphony. Slack now has 4 million users globally, is currently valued at $5 billion and is used in many industries, including the capital markets.

2016

Symphony started a new round of funding.

2017

Thomson Reuters Eikon adds workflow integration to Symphony, while other terminal-based products, like InFront, integrate Symphony into their product set.

And most recently of all, Bloomberg is reportedly unbundling chat services from terminal subscriptions.

Adding Value

So, outside of the basic ‘chat’ offering what else is on offer from Instant Messaging?

Chatrooms

Chatrooms are an established feature of IM applications and provide a powerful reason to embrace IM.

For the capital markets, chatrooms are highly customisable, users and even companies can be restricted from access due to security or regulatory issues. For example, Thomson Reuters has the bilateral chat feature for their Eikon Messaging – preventing unauthorized multi-firm chats.

Incidentally, CJC currently has over thirty chatrooms (and growing) across our business to communicate both internally and externally to partners and client firms. Their purpose can range from a general forum through to specific requirements, but the functionality is always the same – to get the right human beings communicating.

Workflow

When Reuters introduced conversational dealing, a big industry issue around voice trading was solved. Clients had little voice recording capabilities and so trades could be mis-communicated. IM provided a simple, black and white log of the trade and thereby became part of the dealing workflow.

From here, that trade information/ticket order is then automatically sent into other middle and back office systems.

So IM is now a staple part of client workflow at multiple institutions and of course in the mass market. Major examples include the ability in Salesforce to allocate a sales lead via Chatter/Symphony and have approvals of quotes etc. This process is mirrored at CJC with ITSM (Jira/Cherwell), with incident or change tickets being automated to engineers/service managers.

Another major development has been the combination of workflow and chatrooms. As an example, some clients escalate incidents to CJC directly from their monitoring system into a CJC/Symphony Chatroom.

Chatbots and Artificial Intelligence (AI)

Think of how voicebots such as Siri or Cortana are being used on various smartphone or PC platforms and how Alexa is now a popular term in many households. Now imagine that power being added to your organisation – in this case, IM is the delivery platform for the query.

Chatbots are a way of initiating a process or simply asking a question that you may ask today to colleagues or your intranet. The AI will search for these answers inside your infrastructure. The chatbots can even ask other chatbots!

Not convinced? Imagine using Alexa for this:

“Hey Alexa – give me a list of the departments who subscribe to Nasdaq Basic

- Who approves new data requests?

- When did we last have a market data audit?

- Who ran the compliance team in 2015?"

Chatbots and AI can be developed to provide automation for the aforementioned workflow – CJC and our clients are working on chatbots to initiate and automate workflow.

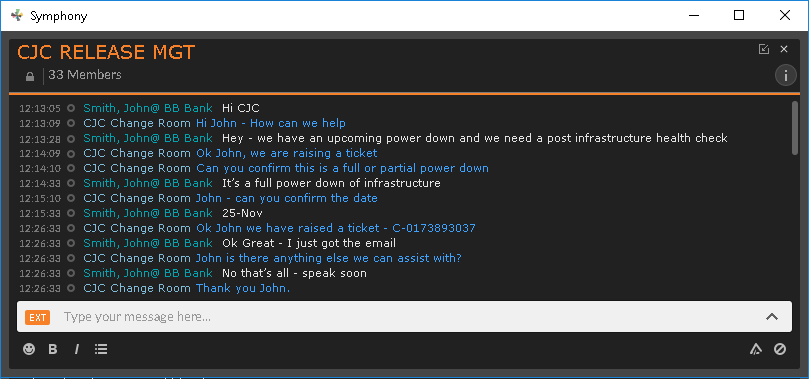

The conversation above is between a human contact and a chatbot. During the dialogue, the chatbot uses a decision tree to provide answers, while simultaneously integrating with our ITSM, creating a ticket and using the client’s answers to populate fields. Instant Messaging is also used to alert the operations team to the job.

The power of chatbots is incredible. For example, outside of the capital markets, health organisations including NHS are looking to chatbots and AI as an alternative to non-emergency contacts and ensuring people are taking their medication and aftercare.

So in conclusion, for over forty years instant messaging has proven to be a powerful platform with the ability to create seismic landscape changes. In the capital markets – firms have to understand the benefits from both a community and enterprise perspective.

Get In Touch

your market data ecosystem!